What is Comparative Market Analysis?

When buying or selling a property, one of the most important factors to consider is its value. The value of a property is influenced by a wide range of factors, including its location, condition, and size. To determine the value of a property, real estate professionals use a tool called Comparative Market Analysis (CMA). In this article, we will explore what a CMA is and how it is used in the real estate industry.

What is Comparative Market Analysis (CMA)?

A Comparative Market Analysis is a tool used by real estate professionals to determine the value of a property. It involves researching similar properties that have recently sold in the same area. The goal of a CMA is to find properties that are comparable to the property in question in terms of size, condition, and location. By analyzing the selling price of these comparable properties, the real estate professional can determine a fair market value for the property in question.

How is a CMA performed?

The first step in performing a CMA is to gather data on the property being evaluated. This includes information about the property’s size, age, and condition. The real estate professional will also consider the location of the property and the local real estate market.

Once the property information has been gathered, the real estate professional will research recently sold properties that are similar to the property being evaluated. This includes properties that are similar in size, age, and condition, as well as those in the same or similar neighborhoods.

The real estate professional will then analyze the selling price of these comparable properties to determine a fair market value for the property being evaluated. They will also take into account any unique features or upgrades that may impact the value of the property.

Why is a CMA important?

A CMA is an important tool for both buyers and sellers of properties. For buyers, a CMA can help them to determine a fair price for a property they are interested in. It can also help them to identify properties that may be overpriced and those that are a good value.

For sellers, a CMA is an important tool for setting the right price for their property. Pricing a property too high can result in it sitting on the market for an extended period of time, while pricing it too low can result in a loss of potential profits. A CMA can help sellers to set a competitive price for their property that is likely to generate interest from buyers.

In conclusion, a Comparative Market Analysis is an essential tool used in the real estate industry to determine the value of a property. By analyzing the selling price of comparable properties, real estate professionals can set a fair market value for a property, enabling buyers and sellers to make informed decisions about buying and selling real estate.

Categories

Recent Posts

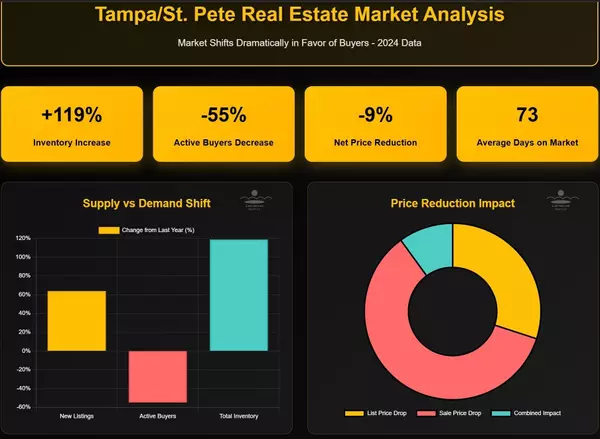

Tampa/St. Pete Real Estate Market Shifts Dramatically in Favor of Buyers

What To Look Out For When Viewing A Property:

Renting vs. Owning: Which Option is Right for You?

What is Comparative Market Analysis?

Questions Your Real Estate Agent Should Be Asking YOU!

Benefits of Home Ownership: Why Owning a Home is a Smart Investment:

How Real Estate Agents Determine Property Prices:

How To Make Sure You're Getting A Good Price On A Home:

Top Ten Coffee Shops In St. Pete:

7 Essentials For Condo Buyers:

GET MORE INFORMATION