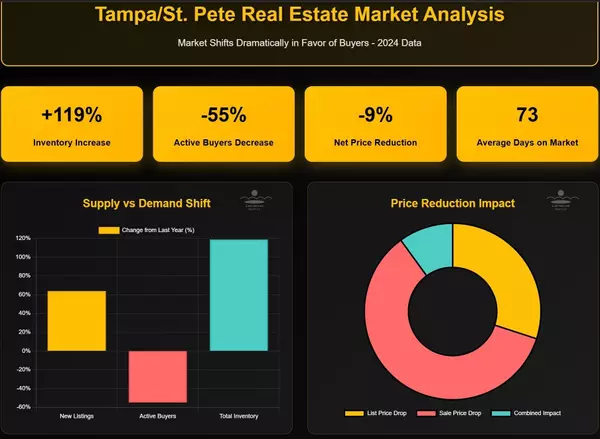

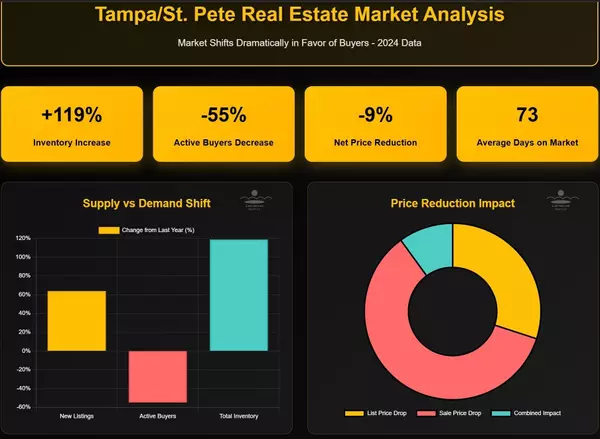

Tampa/St. Pete Real Estate Market Shifts Dramatically in Favor of Buyers

The Tampa/St. Petersburg real estate market, long a hotbed for sellers, has undergone a seismic shift, tilting heavily in favor of buyers. Recent data paints a clear picture of a market cooling rapidly, offering unprecedented opportunities for those looking to purchase a home in this vibrant Florida

What To Look Out For When Viewing A Property:

Looking for a new property to buy or rent can be an exciting and sometimes overwhelming process. It's important to take the time to view properties carefully and consider a range of factors before making a decision. Here are some key things to look out for when viewing a property: Location: The loca

Renting vs. Owning: Which Option is Right for You?

Deciding whether to rent or own a home can be a difficult decision. Both options have their own set of benefits and drawbacks, and the right choice for one person might not be the best choice for another. In this article, we will explore the pros and cons of both renting and owning, so you can make

Categories

Recent Posts