Renting vs. Owning: Which Option is Right for You?

Deciding whether to rent or own a home can be a difficult decision. Both options have their own set of benefits and drawbacks, and the right choice for one person might not be the best choice for another. In this article, we will explore the pros and cons of both renting and owning, so you can make an informed decision about what's best for you.

Advantages of Renting

-

Flexibility: Renting provides you with a great deal of flexibility, particularly if you are someone who likes to move frequently or isn't sure where they want to settle down. With a rental, you can easily move to a new place if you find a better opportunity or if your life circumstances change.

-

No Maintenance Costs: As a renter, you don't have to worry about maintenance costs or repairs. This can save you a significant amount of money and time, especially if you are someone who doesn't enjoy fixing things or isn't handy with tools.

-

Lower Upfront Costs: Renting requires far less upfront costs than buying a home. You will typically need to pay first and last months' rent, as well as a security deposit, but that's it. You won't need to save up for a down payment or pay closing costs, which can be expensive.

-

No Property Value Concerns: When you rent, you don't have to worry about the value of your property declining over time. You are not responsible for any property value changes, which can be a big advantage if you live in an area where the housing market is unstable.

Disadvantages of Renting

-

Lack of Control: When you rent, you are at the mercy of your landlord. You can't make any changes to the property without their approval, and you are subject to their rules and regulations.

-

No Equity: When you rent, you are not building any equity in the property. You are simply paying for the right to live there. This can be a disadvantage if you are someone who wants to build wealth through real estate.

-

No Tax Benefits: Renting does not offer any tax benefits. You won't be able to deduct your rental expenses from your taxes, which can be a significant disadvantage.

Advantages of Owning

-

Building Equity: When you own a home, you are building equity in the property. This can be a great way to build wealth over time, especially if the value of your home appreciates.

-

Tax Benefits: Owning a home provides you with a number of tax benefits. You can deduct mortgage interest and property taxes from your taxable income, which can significantly reduce your tax bill.

-

Control: When you own a home, you have complete control over the property. You can make any changes you like, as long as you stay within the bounds of local laws and regulations.

-

Pride of Ownership: There is a sense of pride and accomplishment that comes with owning your own home. You have a place that is truly yours, and you can create a space that reflects your personal style and tastes.

Disadvantages of Owning

-

Maintenance Costs: When you own a home, you are responsible for all maintenance costs and repairs. This can be expensive, especially if you live in an older home that requires frequent repairs.

-

Long-Term Commitment: Owning a home requires a long-term commitment. You won't be able to move as easily as you can with a rental, and selling your home can be a long and expensive process.

-

Upfront

Categories

Recent Posts

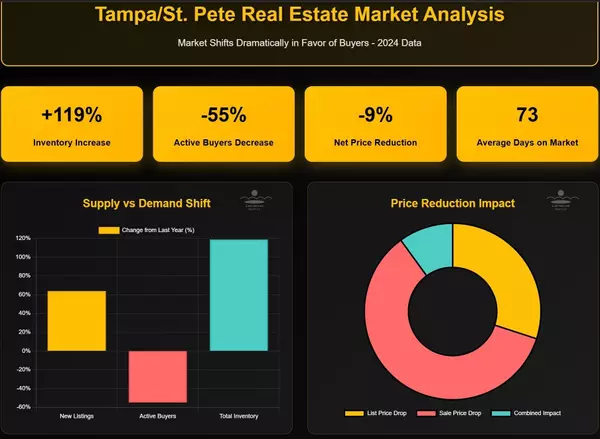

Tampa/St. Pete Real Estate Market Shifts Dramatically in Favor of Buyers

What To Look Out For When Viewing A Property:

Renting vs. Owning: Which Option is Right for You?

What is Comparative Market Analysis?

Questions Your Real Estate Agent Should Be Asking YOU!

Benefits of Home Ownership: Why Owning a Home is a Smart Investment:

How Real Estate Agents Determine Property Prices:

How To Make Sure You're Getting A Good Price On A Home:

Top Ten Coffee Shops In St. Pete:

7 Essentials For Condo Buyers:

GET MORE INFORMATION